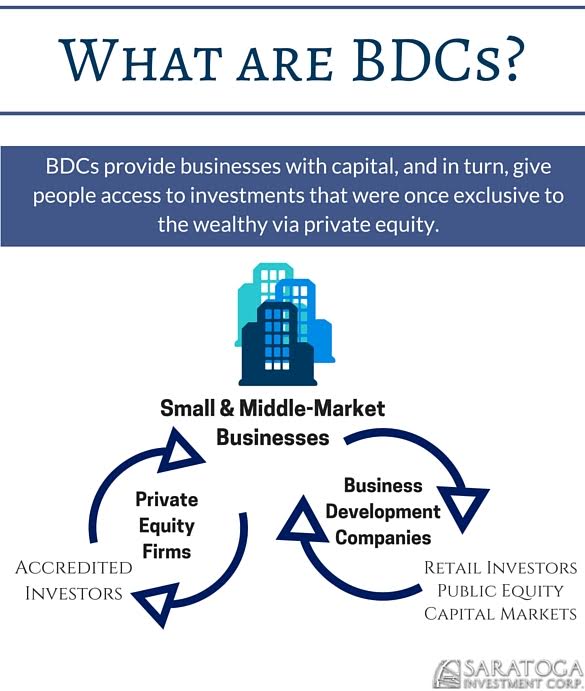

What is a business development company (BDC)? How have these unique investment vehicles transformed an emerging sector into a rapidly growing industry? Why should business owners and investors care? Let’s dive into the basics…

It’s imperative to understand the legal requirements that govern the formation and operation of BDCs. These regulations ensure that business development companies operate within a framework that promotes transparency, investor protection, and overall stability in the financial markets.

To qualify as a BDC, a company must adhere to specific legal criteria. The Investment Company Act of 1940, as amended, is the primary legislation that governs BDCs in the United States. This Act outlines the necessary conditions for a company to be classified as a BDC and enjoy the benefits associated with this designation.

A business development company must be a domestic company, meaning it must be organized and have its principal place of business within the United States. This requirement ensures that BDCs contribute primarily to the growth of the domestic economy and comply with U.S. securities regulations. Business development companies must invest in qualifying assets, such as securities of private U.S. companies, debt securities, and certain other financial instruments. These investments are subject to certain limitations and diversification requirements, which are in place to mitigate risks and safeguard investor interests.

Additionally, BDCs must distribute a substantial portion of their taxable income to shareholders in the form of dividends. This requirement ensures that business development companies pass through their earnings to investors, aligning the interests of shareholders with those of the company. They are also subject to regulatory oversight by the U.S. Securities and Exchange Commission (SEC). Compliance with SEC reporting and disclosure requirements is essential for BDCs to provide transparency to investors and maintain the integrity of the market.

It’s imperative to understand the legal requirements that govern the formation and operation of BDCs. These regulations ensure that business development companies operate within a framework that promotes transparency, investor protection, and overall stability in the financial markets.

To qualify as a BDC, a company must adhere to specific legal criteria. The Investment Company Act of 1940, as amended, is the primary legislation that governs BDCs in the United States. This Act outlines the necessary conditions for a company to be classified as a BDC and enjoy the benefits associated with this designation.

A business development company must be a domestic company, meaning it must be organized and have its principal place of business within the United States. This requirement ensures that BDCs contribute primarily to the growth of the domestic economy and comply with U.S. securities regulations. Business development companies must invest in qualifying assets, such as securities of private U.S. companies, debt securities, and certain other financial instruments. These investments are subject to certain limitations and diversification requirements, which are in place to mitigate risks and safeguard investor interests.

Additionally, BDCs must distribute a substantial portion of their taxable income to shareholders in the form of dividends. This requirement ensures that business development companies pass through their earnings to investors, aligning the interests of shareholders with those of the company. They are also subject to regulatory oversight by the U.S. Securities and Exchange Commission (SEC). Compliance with SEC reporting and disclosure requirements is essential for BDCs to provide transparency to investors and maintain the integrity of the market.

Business owners have a vested interest in understanding the significance of business development companies and how they can impact their operations and growth. Here are key reasons why business owners should care about BDCs:

By recognizing the benefits that business development companies offer, business owners can proactively explore partnership opportunities and leverage the resources and expertise available to drive their companies forward. Ultimately, BDCs can serve as valuable partners in supporting business growth, providing capital, and facilitating strategic initiatives.

Business development companies are smart options for investors looking to strengthen and diversify their financial portfolios.

As many Americans enter retirement, their portfolios are starting to shift away from the traditional financial roadmap. Between longer life expectancy and the volatility of the market, many investors are seeking out more reliable options. With today’s BDC market boasting more than 84 BDCs (traded and nontraded), managing over $70 billion in assets, a growing number of investors are turning their sights on the sector. Today, there are now 57 publicly traded BDCs, allowing retail investors a chance to purchase shares in the growth of middle-market America.

BDCs generally pay out dividends to investors on a monthly or quarterly basis, which means that investors can receive current income through the life of their investment, rather than only at the end.

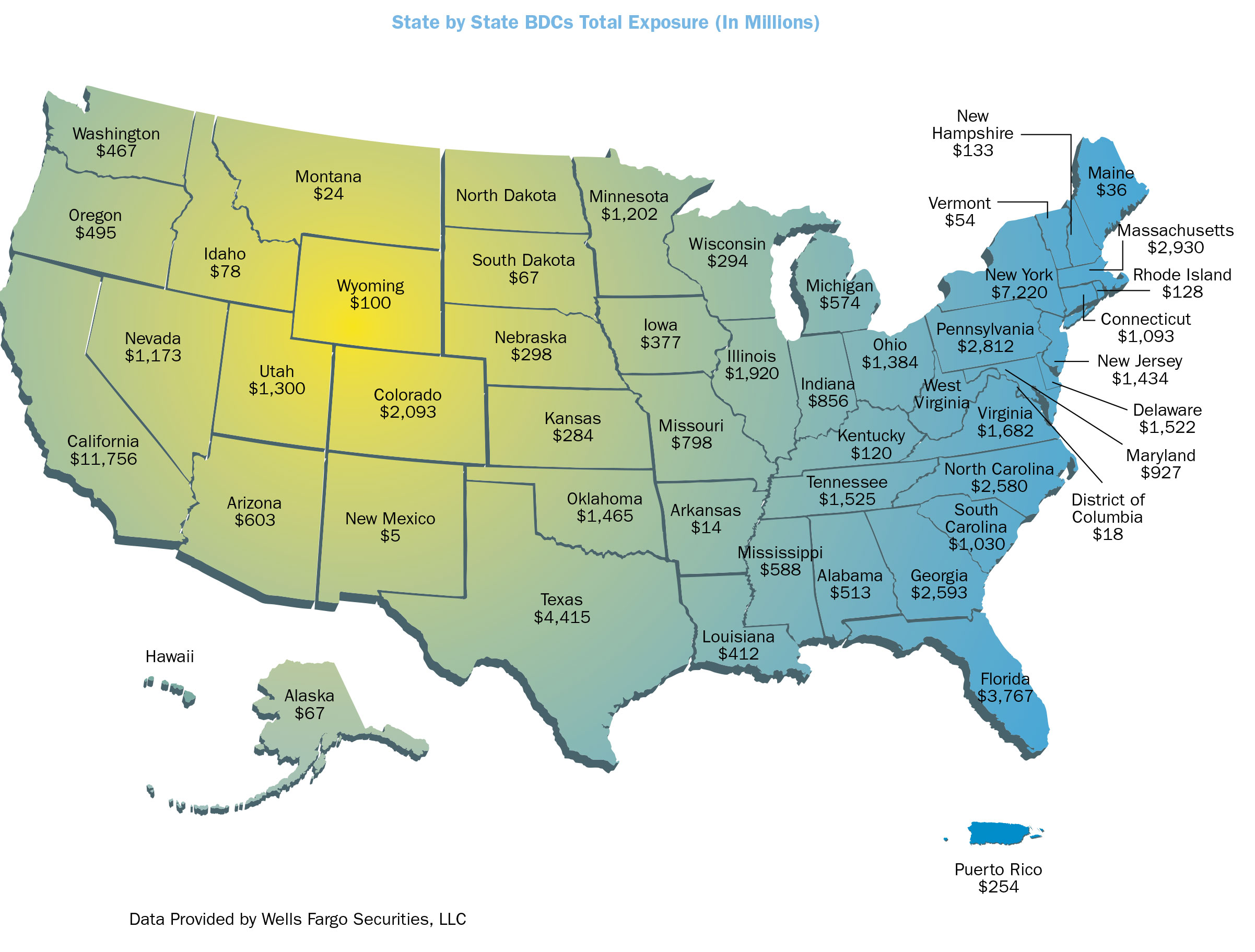

BDCs also help businesses expand and create jobs, thus helping to boost the country’s economy. Growing companies across the country rely on business development companies to finance new capital projects such as land, equipment, and factories. Take a look at this map to see the boom spreading across the United States.

When considering investing in a business development company, it is essential to carefully evaluate certain factors to make informed decisions. Choosing the right BDC requires a thorough assessment of various elements that contribute to the company’s long-term success and potential for generating attractive returns. Here are key aspects to consider:

By carefully considering these factors, investors can identify BDCs that align with their investment goals and risk tolerance. Take a look at our investment profile to see if Saratoga Investment Corp. is the right fit for you.